Natural gas forward prices broke free from oil and other commodities during the March 3-9 period, sending prices sliding ahead of an expected warmup next week, according to NGI’s Forward Look.

April fixed prices fell an average 20.0 cents during that time, while the summer strip (April-October) came off 14.0 cents on average, Forward Look showed. Price decreases for the next winter (November 2022-March 2023) recorded smaller losses, an indication that supplies are expected to remain tight ahead of the peak heating season.

After a slow start to the winter, a prolonged stretch of cold weather in January and February quickly drained storage inventories and set up a steep uphill climb for the market in order to boost stocks this summer.

On Thursday, the Energy Information Administration (EIA) said storage as of March 4 stood at only 1,519 Bcf after falling 124 Bcf on the week.

The withdrawal continued to reflect the tight balances that developed at the start of the year when the first winter blast hit the Lower 48. However, Bespoke Weather Services said the market should be careful to not read too much into the EIA figure. Analysts with the firm saw wind generation as quite low during the reference period, but said it would be an outlier compared to the next few weeks.

“We still project end-of-season storage levels to come in above 1.4 Tcf, on the assumption that the next few weeks will be looser,” Bespoke said.

Broken down by region, South Central inventories slid 38 Bcf to 582 Bcf, more than 18% below five-year average levels, EIA said. Notably, salt stocks of 151 Bcf are a massive 30% under the five-year average. Midwest storage fell 40 Bcf to 364 Bcf, off about 19% from the five-year average, while East storage tumbled 41 Bcf to 317 Bcf, off around 13%.

EBW Analytics Group pointed out that the Midwest region’s meager surplus versus the five-year average steadily eroded throughout the winter, falling in eight of nine year-to-date storage reports to reach an 85 Bcf deficit. More storage declines may lie ahead, according to EBW, with a burst of cold forecast to bring Minneapolis temperatures below zero over the weekend. Chicago could struggle to top 10 degrees, adding further late-season heating demand for the first half of March.

The picture may begin to shift, however, with a notable warm-up into spring, EBW said. Still, in contrast to in-basin production to address deficits in the East or South Central, sizable Midwest deficits require sustained imports from other regions or Canada to address shortfalls.

“Although local distribution companies will follow their mandate and refill storage before next winter, injection demand may support local Midwest basis pricing well into the summer,” EBW senior analyst Eli Rubin said.

Total working gas in storage as of March 4 was 281 Bcf below year-ago levels and 290 Bcf below the five-year average, according to EIA.

Tudor, Pickering, Holt & Co. (TPH) analysts noted that the March 7-11 week has been volatile on both the supply and demand fronts, which could make forecasting the next EIA withdrawal difficult. Residential/commercial (res/com) and power generation reversed early-week deficits, with res/com capping the week off at 39 Bcf/d, 8.4 Bcf/d above norms. Power generation also remains “robust” in the 28.4 Bcf/d range – more than 4 Bcf/d higher than the five-year average – as coal generation has trended lower and renewables generation has fluctuated in recent days.

Supply has remained similarly volatile, with colder temperatures persisting across the Lower 48 and production dipping from 95 Bcf/d to kick off the week toward 93 Bcf/d on Thursday, according to TPH. The firm noted that both the Mid-Continent and Permian Basin trended lower through the week as temperatures dropped.

Looking ahead to the next EIA report, “our preliminary modeling points towards a draw of 85 Bcf, tighter than the five-year average draw of 65 Bcf.” TPH analysts noted that the EIA’s latest 124 Bcf draw was tight by about 3.4 Bcf/d.

First Injection On The Way?

With warmer weather expected in the not-too-distant future, the market is poised to get a jumpstart on the refill season.

Bespoke said the latest weather models show warmer air taking hold in most key areas of the country after the next few days. The forecaster said March, as a whole, may wind up similar to last March in terms of total gas-weighted degree days (GWDD) – if the warmer pattern persists beyond day 15. However, some models indicate possible cooling around that time.

“Of course, we are heading into the time of year when weather changes will move the needle less and less, in terms of overall market impact,” Bespoke said.

EBW noted that independent forecaster DTN’s outlook features only 99 GWDDs, 14 below normal, for the storage week ending March 24. At the same time, production may rise by an estimated 0.5 Bcf/d seasonally from current levels. This sets up the potential for the first injection of the season.

“While forecasts can change rapidly, if an early end to the withdrawal season draws nearer, downward pressure on the front end of the Nymex forward curve is likely,” EBW’s Rubin said.

The analyst noted that further gains in production are likely in the coming weeks as well. Although the current cold snap appears to have cut output by a couple of Bcf, pipeline flow monitors had earlier suggested March production was coming in ahead of late-February levels. As freeze-offs fade, EBW expects output to reach early-December levels later this month, however, a lackluster seasonal supply rebound-to-date may indicate lower production to start the injection season.

Meanwhile, feed gas demand at U.S. liquefied natural gas (LNG) terminals continues to fluctuate amid routine start-up and weather issues. NGI data showed feed gas deliveries at around 13.4 Dth on Friday, up from around 13.1 Dth on Thursday.

Longer term, EBW said the market may have to contend with a larger-than-expected decline in seasonal demand, along with maintenance at various LNG facilities and stronger wind generation that could further dampen gas demand. At the same time, stronger precipitation in the Pacific Northwest could be a boon for spring hydropower generation, while production edges higher. By mid-April, however, local distribution companies (LDC) should pick up the pace on injections, boosting demand and putting a floor under Nymex futures prices, according to EBW.

“LDCs represent price-inelastic demand,” Rubin said. “Their overarching raison d’etre is to ensure adequate supplies such that nobody freezes to death even in a frigid winter. With U.S. natural gas markets pricing in shortage risks last winter and acutely felt shortages ongoing across the pond in Europe, LDCs are likely to aim for a strong refill season to avoid potential complications next winter.”

Notably, these projections are based on fundamentals, and the wave of headlines from Ukraine “can rapidly swing market sentiment,” Rubin said.

April Nymex futures settled Friday at $4.725, up 9.4 cents from Thursday’s close. May futures jumped 9.7 cents to $4.766.

Plunging New England Basis

The vast majority of U.S. pricing locations took their cue from benchmark Henry Hub in the latest forward trading period, but the eventual warm-up sent prices tumbling even more in key New England markets.

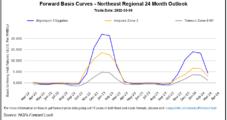

Algonquin Citygate April basis dropped 26.0 cents from March 4-9 to reach plus 18.6 cents, according to Forward Look. May basis, meanwhile, tacked on 8.0 cents to reach minus 52.9 cents. Fixed prices for the summer averaged $4.240 after falling 18.0 cents through the period, but the winter strip picked up 24.0 cents to average $18.840.

Similar price behavior was seen at Tennessee Zone 6 200L, with April basis shedding 25.0 cents to hit plus 24.0 cents and May basis rising 9.0 cents to minus 47.5 cents, Forward Look data showed. The summer strip fell 17.0 cents to average $4.290, while the winter jumped 25.0 cents to $18.883.

The spike in winter prices across New England reflects an expectation of strong winter demand and tight supplies, along with the potential for the region to have to price enough to compete with global markets for LNG supplies during periods of extreme demand.

With little spare pipeline capacity, New England this winter relied on LNG imports to meet strong heating needs in the region amid the prolonged cold. And before the projected warmup later this month, another heavy dose of wintry weather is on the table.

AccuWeather said a heaping amount of snow, ice and pounding winds are forecast to strengthen into a bomb cycle along the Eastern Seaboard beginning Friday evening. This would bring “intense weather and dramatic weather changes to the eastern half of the nation, with the most extremes in store for the Northeast,” according to AccuWeather senior meteorologist Dave Dombek.

Even though the snow portion of the storm is likely to last only eight to 12 hours and perhaps just a few hours in some areas, impacts will be significant, AccuWeather said. The storm is projected to first take shape along the central Gulf coast on Friday before turning to the north-northeast and moving up along the Eastern Seaboard on Saturday.

The combination of plunging temperatures from the 30s to the 20s and even the teens in some areas could cause snow to accumulate and slushy areas to freeze, according to the forecaster. Snowfall may come down heavily, causing white-out conditions, with snow persisting for longer across areas farther to the north. Blizzard conditions are most likely to unfold across northern New York and northern New England on Saturday, AccuWeather said.