The African Group of Negotiators on Climate Change (AGN), thetechnical body of Africa's three-tier negotiating structure, isplanning to meet from March 14-17 in Livingstone, Zambia to reviewthe outcome of last year's United Nations Climate Change Conferenceof Parties (COP26). Discussions will focus on the outcomes of COP26on sub-Saharan Africa (SSA), ahead of COP27 due to be held in Egyptin November 2022.

Key points

SSA countries received insufficient financial pledgesat COP26 to cover their full climate adaptation needs, but they didreceive substantial commitments

UNFCCC estimates indicate that about USD125 trillion of directcapital investments are needed to transform the global economy andavoid the worst physical impacts of climate change by 2050. Ofthis, about USD32 trillion of investments is needed by 2030, out ofwhich USD1.7 trillion (5.3%) of this amount is required in SSA -that is, USD170 billion per year. This equates to 100% of theregion's GDP in 2020. Renewed pledges for adaptation made at COP26equate to USD40 billion in funding by 2025, but this falls short ofestimates by the UN Environment Programme (UNEP) that annualadaptation costs for developing countries would total USD70billion. Despite the huge financing challenges ahead, some SSAcountries did manage to secure important financing deals at COP26to support their individual energy transition plans. South Africa -the continent's most industrialized economy and largestcarbon-dioxide (CO2) emitter - secured a USD8.5-billion deal underthe Just Energy Transition Partnership with the United States, theEuropean Union, and several individual European countries, aclimate-finance swap to close several coal-fired power plants andlaunch renewable projects to replace them. However, to unlock thisfunding, the South African government is very likely to be requiredto build a viable pipeline of eligible projects.

SSA governments face growing difficulty in attractingfunding for carbon-intensive projects since investors are focusingincreasingly on environmental, social and governance (ESG)objectives.

There is a broad consensus among the world's leading donorcountries to end international financing of projects producingcarbon-intensive fossil-fuel energy sources, namely coal andupstream oil. The pursuit of ESG objectives has already resulted inthe withdrawal of financing commitments to projects in thesub-Saharan Africa region. For example, in November 2021, Chinaannounced that it would no longer finance a 3-megawatt coal powerplant in South Africa's Limpopo province. Narrow support formidstream and downstream natural gas projects remains, but upstreamnatural gas projects face even greater financing challenges. TheEuropean Commission published the Complementary Climate DelegatedAct, which deems natural gas a 'transition' energy source, makingthe investment in natural gas projects compatible with the EU's2050 net-zero goal. Similarly, the World Bank stated that it would,in "exceptional circumstances", support upstream natural gasprojects. Nonetheless, financial disclosure requirements regardingcarbon emissions, pressure from shareholders, and concerns of'green-washing' among potential investors when raising capitalappear increasingly likely to reduce the appetite of regional anddomestic financial institutions, including sovereign wealth funds,to continue support to hydrocarbon projects. Consequently, fossilfuel projects are likely to face increasing difficulty in findinginvestment guarantees, political risk insurance, and performancebonds, typically sought to mitigate project risks, perceived to behigh in SSA.

Regional multilateral development banks (MDBs) andprivate capital sources are unlikely to fill the gap left bytraditional financing sources.

African governments are likely to turn to regional MDBs,domestic financial institutions such as sovereign wealth funds andpension funds, and aspirational regional middle-class privateinvestors with investment capital to fund strategic fossil-fuelprojects. For example, on 27 January 2022, African Export-ImportBank (Afreximbank) announced USD5-billion funding for Nigeria'snational oil company, Nigerian National Petroleum Company Ltd,under a resource-backed loan arrangement for greenfield andbrownfield projects in the country's upstream sector. Privateinvestment from domestic sources is also likely to increase inupstream fossil fuel projects. In Tanzania, local firm MiramboMining bought a controlling stake in Tancoal Energy, which, fromits Ngaka coalfield, is reportedly East Africa's biggest supplierof the fuel.

SSA countries are likely to benefit from a range of newrevenue sources relating to the energy transition

Agreement at COP26 on Article 6 rules under the Paris Agreementhas opened up a potential new avenue for SSA countries to tapgrowing international demand for offset projects in voluntarycarbon markets, which in 2021 achieved over USD1 billion a year innominal trade. The International Emissions Trading Associationestimates that Article 6 could lead to a reduction in the totalcost of NDC implementation by about USD250 billion per year in2030. Although Africa currently accounts for less than 3% of globalcarbon trading, Gabon announced plans to place up to USD5 billionof carbon credits on the market in 2022 after passing its climatelaw in September 2021. Gabon possesses 13% of the Congo Basinrainforest, absorbing 100 million tons of CO2 (net) per year. TheDemocratic Republic of the Congo (DRC) has similar ambitions tosecure funding for preservation efforts in its portion of the CongoBasin, signing a USD500-million investment deal with the UK atCOP26.

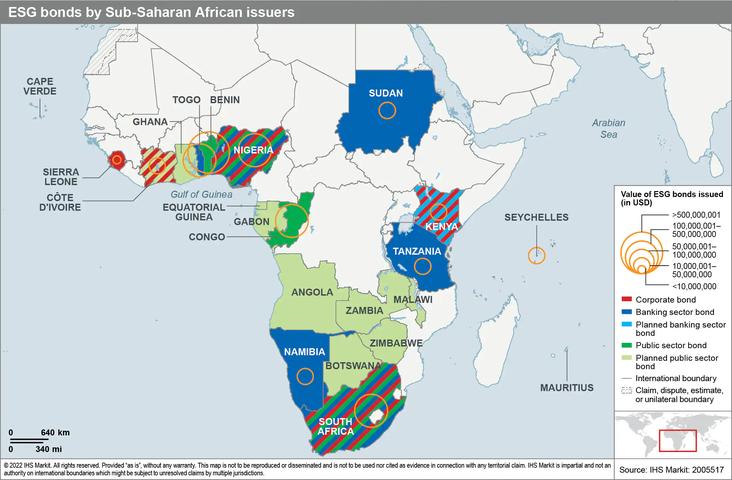

Finally, there has been some skepticism about the upside fromArticle 6 as it rules out double counting, creating a ceiling oncarbon emissions for developing countries - particularly SSA withthe lowest emissions globally (less than 4%). SSA countries thathave issued green bonds (to support renewable energy projects,clean transportation, and climate adaptation projects) and bluebonds (to support sustainable marine and fisheries projects), atthe sovereign and municipal levels, in recent times include SouthAfrica (USD200 million in 2020).

Given that funding is increasingly likely to beprioritized and shifted towards clean energy, innovation, andenergy efficiency, some SSA countries should benefit from theopportunities of mitigation and decarbonization in key sectors suchas power, transport, agriculture, construction, mining, and naturalgas

In this regard, countries such as Gabon, Ghana, and South Africahave commenced developing and implementing policies around asustainable circular economy, particularly deepening renewableenergy penetration in the total energy mix. Further, the EU GreenNew Deal's circular economy plan presents opportunities to localizeparts of the value chain to African producers and strengthen valueaddition by promoting manufacturing - which will become even morecritical as the EU's carbon border adjustment mechanism isintroduced. Finally, African governments are seeking increasedinvestments in new forms of resource-based industrialization usingcritical minerals such as copper and cobalt, which are vital forthe energy transition and abundant on the continent.

Posted 09 March 2022 by Natznet Tesfay, Executive Director, Africa, Economics & Country Risk, IHS Markitand

Peter Gardett, Executive Director, Climate and Cleantech, IHS Markitand

Theo Acheampong, Ph.D., Senior Analyst Country Risk – Sub-Saharan Africa, IHS Markitand

William Farmer, Analyst, Sub-Saharan Africa, Country Risk, IHS Markit

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.