Outlook: Today we get retail sales but it’s the Fed and hardly anything else (except Zelensky). As noted above, we see weird and scary roiling going on in the charts that can bring paralysis—or a reversal. Two causes present themselves. One idea is starting to believe the war can be ended. Maybe Putin can be bribed to quit. Maybe he really does run out of money and can’t re-supply the military. Maybe Ukraine holds out for more months than seems humanly possible now. Everyone says the war is going to last many months—but what if it were to end early? It’s disheartening to see grown up people place perfectly good money on bets that Putin will do something worthy.

The more realistic explanation for whirlpools in the charts is the idea is that the Fed will engage in what the smarty-pants call a dovish hike, meaning the Fed does hike, but expresses anxiety about whether it can or should keep it up. Traders do not like wishy-washy central bankers; they also don’t like over-confident ones, so it’s a fine line. We are more likely to see uncertainty in the dot plots than in Mr. Powell’s press conference. The idea the Fed would act once and then go on hold for many months is contrary to the consensus of one hike per month all year, and equally important (not surprising markets is important to the Fed), it would run counter to the Fed’s legal mandate to control inflation, something we obviously need.

If traders judge the Fed as wimpy, the dollar will take a bath. It would look strange to have the euro rising while most of the eurozone members are as good as engaged in war, but the FX market can swallow many impossible things before breakfast. We don’t usually chicken out on Fed day, but this is one of them.

The other side is possible, too—the Fed may not be aggressive in the form of the hike itself, “only” 25 bp instead of 50, but could say out loud a 50 bp version is on the table (or not off it) and so are all the other hikes already expected. Granted, the Fed is still at (maybe) three or four while everyone else is at 7, but whatever the number, no hiatus in hikes because of the war or for any other reason. In addition, the Fed could affirm it will start QT in May or June. That would be the full-bore, pull-no-punches hawkish version. The steepening yield curve alone would put some starch in the dollar’s spine. (Do we think the Fed gives a fig for the dollar and consider it in a time like this? No.).

We see corners of wishful thinking, delusional thinking, foolish thinking—to buy euros because the war will end soon is astoundingly silly. To sell dollars because the Fed is going to fall short on ramping up rates to meet inflation is also silly. If we cannot trust the central bank to take the right actions (according to orthodoxy), we should be selling the hell out of the dollar—but that doesn’t mean buying euros in the midst of a European ground war that is going to cost as ton of money and cause restructuring of every budget. Most of all, traders are toying with commodity prices like reckless toddlers.

Foreign Affairs: Russia’s reach exceeds its grasp. This is a common mistake of autocrats who brook no new information they don’t like. Russia does it quite often. In the Prague Spring (August, 1968), Russia overthrew the Czechoslovakian government but then didn’t know what to do with it. Russia made a similar mistake in Afghanistan, installing their puppet but never ending the insurgency. Ukraine is worse for Russia, not only because the Ukrainians are brave but also because Zelensky is a show-biz professional and knows how to run an information war, as Stephen Kotkin points out in the New Yorker.

Kotkin says “The biggest surprise for Putin, of course, was the West. All the nonsense about how the West is decadent, the West is over, the West is in decline, how it’s a multipolar world and the rise of China, et cetera: all of that turned out to be bunk. The courage of the Ukrainian people and the bravery and smarts of the Ukrainian government, and its President, Zelensky, galvanized the West to remember who it was. And that shocked Putin! That’s the miscalculation.”

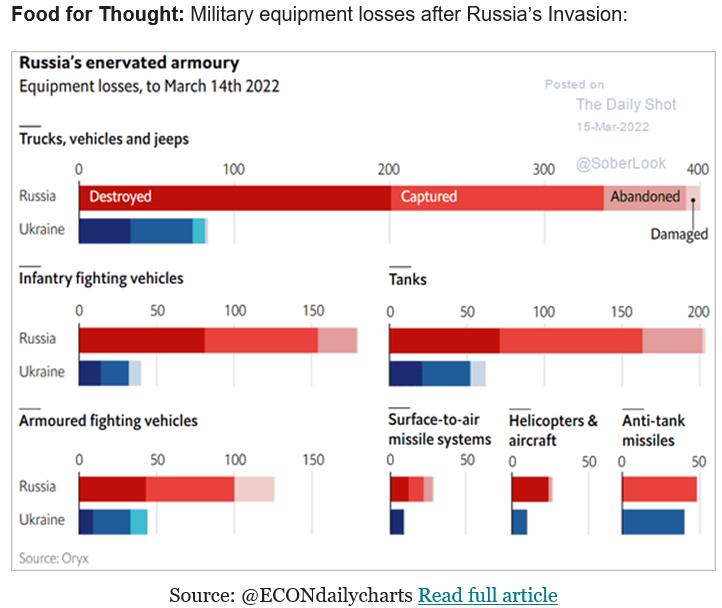

And we’d add it’s possible the Russian military is actually not competent. TV reporting says the Russians didn’t have enough food and fuel, and are foraging among the rubble. Note the Russian convoy, about 40 miles long, is still stuck outside Kiev more than two weeks after it was supposed to conquer the city. The Russians have reportedly lost more soldiers, trucks, tanks, aircraft, etc. than the far smaller Ukrainian military. See the comparison from the Daily Shot. Putin must be hopping mad, assuming anyone has the nerve to inform him. When the invasion started, many people asked why he didn’t do it when his poodle Trump was still in office. The answer then was that the Russian military was not ready. We thought that a lame story, but now it seems all too likely.

Former Nato supreme allied commander Stavridis is all over TV and the press addressing the obvious shortcoming of the Russian military. He concurs that the logistics for the invading force were bungled, hence the shortages of everything from bullets to food. Secondly, most of the troops are badly trained conscripts, some of whom don’t even know what country they invaded or that what they are doing is an invasion and not just some exercise.Third is lousy leadership—six axes of assault is too many.Stavridis says killed-in-action is likely about 4,000 in just two weeks, compared to 2000 Americans killed in Afghanistan in 20 years.

A footnote to the welcome to Ukrainian refugees compared to riots when it was Middle Easterners at the gates of Europe—it’s definitely not nice to say, but “they look like us.” Pretty girls, manly men who shave, women without headscarves, beautiful babies. They are white. They are Christian. They are okay and deserve a cup of tea and a bed. We have come far, but how little has changed in the European tribe.This is probably unfair to Sweden and Italy, but still. We are about to find out how many the US will invite from Ukraine while trying to keep the Mexican border closed.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!